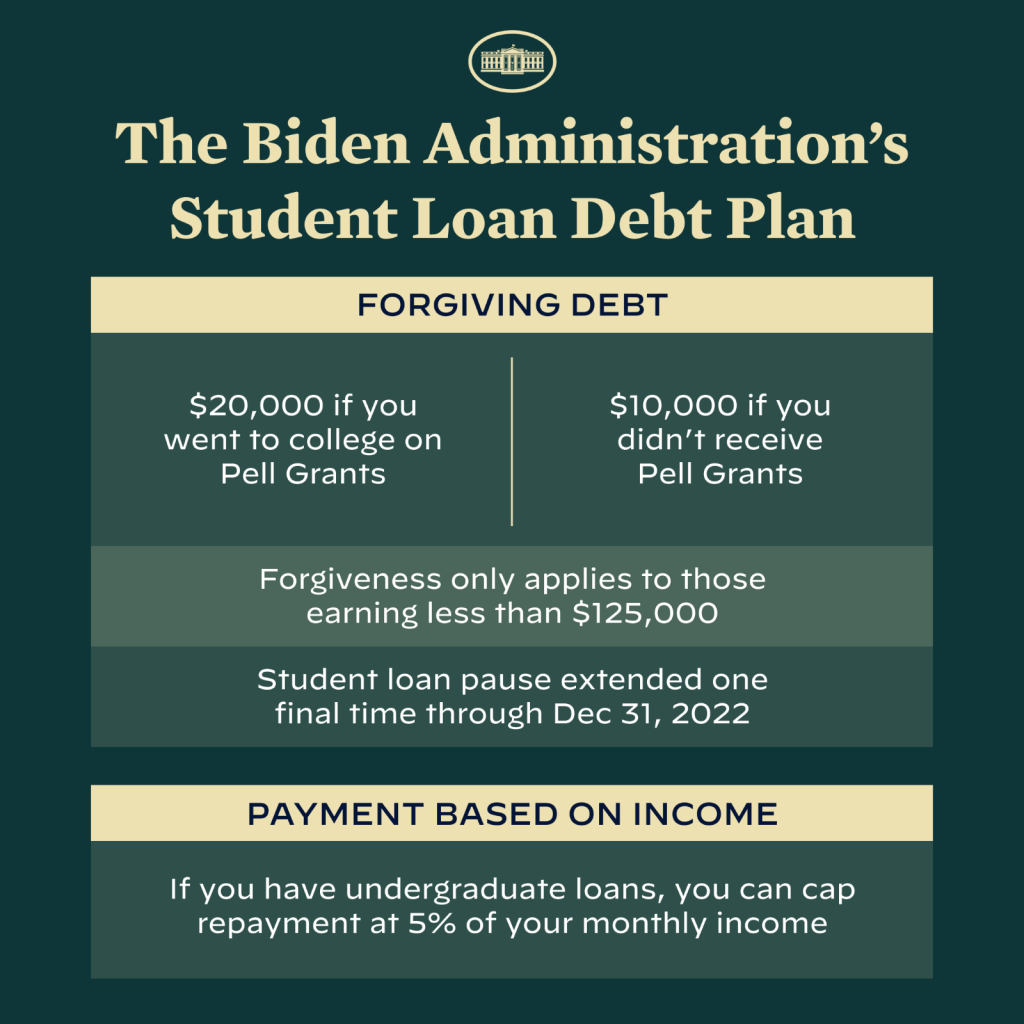

On August 24, 2022, the Biden administration announced a three-part plan to help federal student loan borrowers, including:

- Loan forgiveness of up to $20,000 to Pell Grant recipients and $10,000 in debt cancellation to non-Pell Grant recipients for individuals earning less than $125,000 per year and married couples making under $250,000 per year. Parent Plus loans are also included as qualifying loans in this debt relief.

- A pause extension on federal student loan repayment through December 31, 2022.

- Make the current loan system more manageable for current and future borrowers by:

- Making loans payments affordable by limiting payments to 5% of a person’s income.

- Fixing the Public Service Loan Forgiveness (PSLF) program to ensure our public servants receive appropriate loan forgiveness, something Senator Merkley has led the charge to reform.

- Protections for future students and taxpayers, including reduction in the cost of higher education and accountability mechanisms to hold schools accountable when they hike up prices.

Senator Merkley applauds this action as a step forward and a catalyst for future reforms. Affordable college for every student will produce a more prosperous future for all. View Senator Merkley’s full statement on the Biden administration’s announcement on student loan debt.

Resources:

Student Debt Relief Application Portal

Federal Student Aid Office, part of the U.S. Department of Education

Information about Federal Student Debt Relief from the U.S. Department of Education

Fact Sheet on Student Loan Relief from the White House

October 2022 Udpate on the Biden-Harris Administration’s Student Debt Relief Application

This week the Biden-Harris Administration previewed the Student Loan Debt Relief application form. Here’s what you need to know:

- The application will be available later this month.

- It’s short, simple, free, and will be available online at a “.gov” URL.

- You don’t need to log in or provide any documents to apply.

- Federal Student Aid will reach out directly once you’ve submitted your application if you need to provide additional information.

- You will be able to fill out the application on both mobile and desktop devices.

- The application will be available in both English and Spanish when it goes live.

- NOTE: there will also be assistance, via phone, for translating the application in languages other than English and Spanish.

- The application period will run from October 2022 through December 31, 2023.

- Borrowers are encouraged to submit the application prior to November 15, 2022 in order to receive forgiveness by the time that student loan payments restart on January 1, 2023.

- To be the first to be notified about when the student debt relief application is available, sign up for updates at http://StudentAid.gov/DebtRelief.

You can view the application preview here.

September 2022 Update on the Biden-Harris Administration’s Student Debt Relief Plan

In August 2022, President Biden announced his administration’s plan to provide student debt relief to eligible borrowers and give working and middle-class Americans more breathing room.

Who’s eligible?

You are eligible if you have most federal loans (including Direct Loans and other loans held by the Department of Education) and your income for 2020 or 2021 is either:

- Less than $125,000 for individuals

- Less than $250,000 for households

If you are a dependent student, your eligibility is based on your parental income.

What am I eligible for?

- Up to $20,000 in debt relief if you received a Pell Grant in college

- Up to $10,000 in debt relief if you didn’t receive a Pell Grant

How will it work?

- In October, the Department of Education will launch a short online application for student debt relief. You won’t need to upload any supporting documents or use your Federal Student Aid (FSA) ID to submit your application.

- Once you submit your application, the Department will review it, determine your eligibility for debt relief, and work with your loan servicer(s) to process your relief.

- The Department will contact you if they need any additional information from you.

What’s next?

- Right now, you don’t need to do anything! The Department of Education will contact you when the sign-up period for student debt relief opens, and we will post more information here.

- You can log in to your account on StudentAid.gov and make sure your contact information is up to date. The Department can send you updates by both email and text message. If it’s been a while since you’ve logged in, or you can’t remember if you have an account username and password (FSA ID), the Department offers tips to help you access your account.

- If you don’t have a StudentAid.gov account (FSA ID) you should create an account to help manage your loans.

- The Department will send you regular updates with more details over the coming days, as we near the application period, which will begin in October 2022 and last through December 2023.

- In the meantime, visit the Department’s Frequently Asked Questions page to find out more information on the student debt relief program.

Beware of Scams

You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. You never have to pay for help with your federal student aid. Make sure you work only with the Department of Education and its loan servicers, and never reveal your personal information or account password to anyone.

Emails to borrowers will come from noreply@studentaid.gov, noreply@debtrelief.studentaid.gov or ed.gov@public.govdelivery.com.

You can report scam attempts to the Federal Trade Commission by calling 1-877-382-4357.